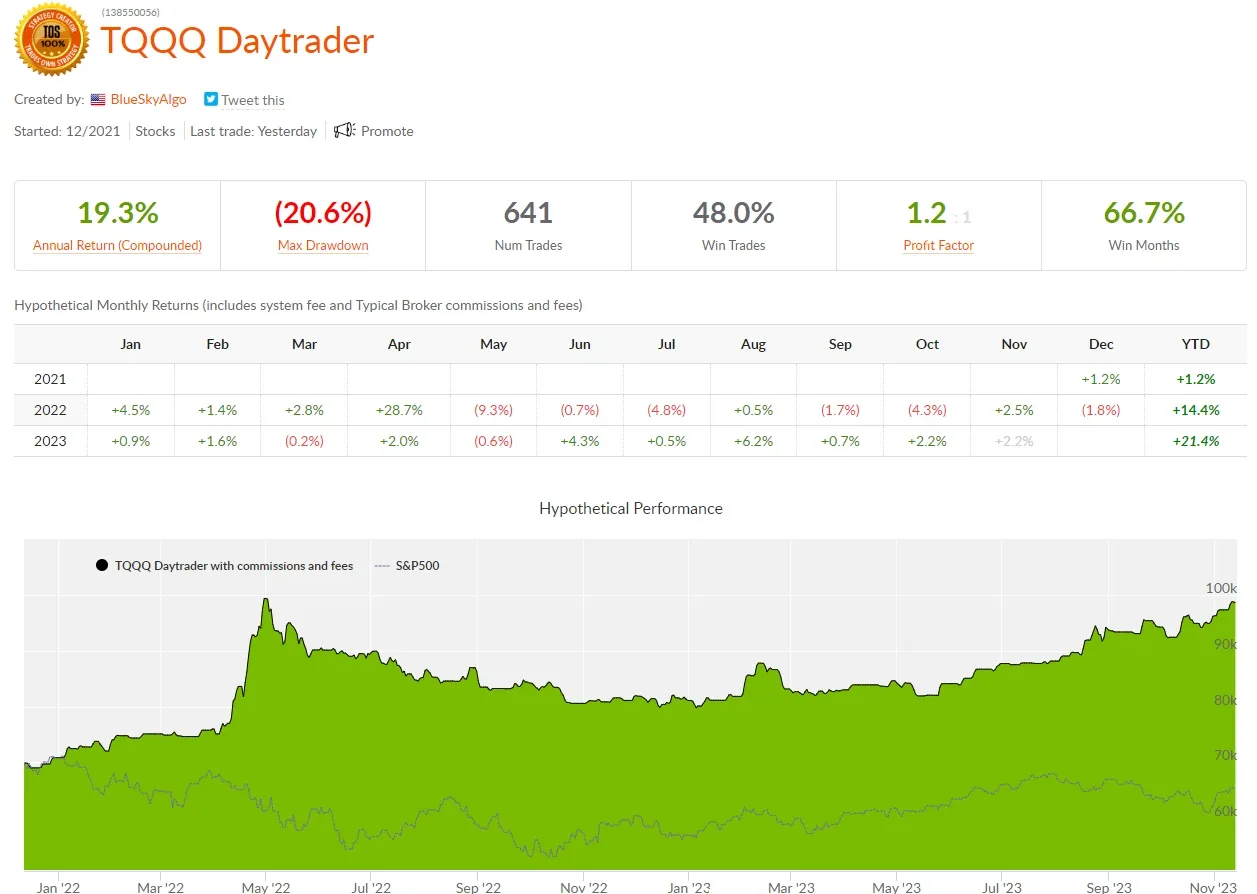

“TQQQ Daytrader” is a fully automated day trading strategy developed and managed by our company, Blue Sky Algo, LLC. It focuses exclusively on buying/selling short TQQQ stock, which track the NASDAQ-100 stock index at 3X leverage. No positions are held overnight and the average duration of each trade is 47 minutes. Here are the key features:

Disclaimers and Disclosures

Trading Involves Risk! You Must Understand These Risks!

Trading Risk Disclaimers

As advised by the NFA, CFTC and the FCA, trading Foreign Exchange or any other financial market (“financial markets”) on margin or as a leveraged product carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against traders as well as for traders. You must be aware of and understand all of the risks and accept them in order to invest in or trade financial markets. Before deciding to invest in or trade financial markets, you should carefully consider your investment objectives, level of experience, and risk appetite. By undertaking these types of high-risk trades, you acknowledge that you are trading with your available risk capital and any losses you may incur will not adversely affect your lifestyle. The possibility exists that you could sustain a loss of some of, all of, or more than your initial investment and therefore you should not invest or trade with money that you cannot afford to lose. You should be aware of all the risks associated with investing in and trading financial markets and seek advice from an independent financial advisor. This Software does not constitute financial advice in any form, nor does it constitute a solicitation nor an offer to Buy, Sell or Hold any financial instrument, investment or product in any financial markets. No representation is being made that any account will or is likely to achieve profits or losses similar to those achieved by anyone else or any other software. The past performance of any trading system or methodology is not necessarily indicative of future results.

Hypothetical Performance Disclosure

As advised in CFTC Rule 4.41, hypothetical or simulated performance results have certain limitations. Unlike an actual performance record, simulated results do not represent actual trading. Also, since the trades have not been executed, the results may have under- or over-compensated for the impact, if any, of certain market factors, such as lack of liquidity. Simulated trading programs in general, as well as hypothetical performance results, are also subject to the fact that they are designed with the benefit of hindsight. No representation is being made here that any account will or is likely to achieve profit or losses similar to those achieved by anyone else or any other software, nor as may be stated or implied on this website. In fact, there are frequently sharp differences between hypothetical performance results and the actual results subsequently achieved by any particular trading program. In addition, hypothetical trading does not involve financial risk, and no hypothetical trading record can completely account for the impact of financial risk of actual trading. For example, the ability to withstand losses or to adhere to a particular trading program in spite of trading losses are material points which can also adversely affect actual trading results. There are numerous other factors related to the markets in general or to the implementation of any specific trading program which cannot be fully accounted for in the preparation of hypothetical performance results and all which can adversely affect trading results.

Remember, Only ONE Person Makes Decisions About Risk in Your Trading: YOU!

Know the Risks, and Accept Them IF You Trade … and TRADE CAREFULLY!

To ensure full disclosure, Blue Sky Algo, LLC is an authorized Third-party Vendor for NinjaTrader LLC.